Investing Ideas

Investing Ideas

"Immer mehr lokale Unternehmen schaffen Wohlstand"

_

Mit der Osterweiterung der Europäischen Union im Jahr 2004 ist für die Wirtschaft gleich mehrerer Länder eine Art Goldenes Zeitalter angebrochen. Marcin Piątkowski, Professor an der Kozminski-Universität in Warschau, erläutert diese tiefgreifende Transformation.

Investing Ideas

Top-Firmen aus dem Osten

_

In Osteuropa gibt es viele wahre "Nuggets", die im Westen kaum bekannt sind. Hier unsere Auswahl.

Investing Ideas

Werbung - ein lukratives Geschäft

_

Schon 2025 dürfte der weltweite Werbemarkt die symbolische Schwelle von einer Bio. Dollar Jahresumsatz überschreiten. Eine einträgliche Branche mit grossen Unterschieden.

Investing Ideas

Growth from Eastern Europe

_

The countries of Eastern Europe, which have joined the European Union in successive waves over the last 20 years, have experienced phenomenal growth. We take a closer look at this economic miracle.

Investing Ideas

Wie KI die Werbung revolutioniert

_

Die generative künstliche Intelligenz (KI) hat erfolgreich in der Welt des Marketings und der Werbung Einzug gehalten. Allerdings stösst diese Technologie nach wie vor auch auf Bedenken.

Investing Ideas

Interview mit Yves Mäder, Werbeexperte bei Google

_

Yves Mäder ist Spezialist für künstliche Intelligenz (KI) im Online-Marketing bei Google Schweiz. Er unterstützt grosse Werbekunden beim effizienten Einsatz von KI für Werbekampagnen. Wir haben mit ihm über die künftige Entwicklung gesprochen.

Investing Ideas

«Wir wachsen schneller als der Markt»

_

Kurz vor Ostern legte das Zuger Unternehmen Galderma, ein Pure Player im Bereich der Dermatologie, einen fulminanten Start an der Schweizer Börse hin. CEO Dr. Flemming Ørnskov erklärt auf Anfrage von «Swissquote Magazine», was sein Unternehmen attraktiv macht.

Investing Ideas

Asien: Eldorado für Beauty‑Marken

_

Die gesamte Schönheitsindustrie blickt gebannt auf Asien. Denn Südkorea erweist sich als wahre Inspirationsquelle – und China ebenso wie Indien sind wichtige Wachstumsmärkte.

Investing Ideas

Beauty‑Branche auf Gesundheitstrip

_

Sie wächst und wächst: Mit einem jährlichen Plus von rund 5 Prozent beeindruckt die globale Beauty‑Branche die Anleger mit ihrer unglaublichen Konstanz. Hinter diesem Erfolg zeichnen sich allerdings gravierende Veränderungen ab.

Investing Ideas

Was die Schweizer Forschung bedroht

_

Die Schweizer Wissenschaft belegt weltweit Spitzenplätze. Aber sowohl die akademische Welt als auch Wirtschaftskreise befürchten, dass die Schweiz zurückfallen wird, wenn die Budgets nicht erhöht werden und keine Annäherung an Europa zustande kommen sollte.

Investing Ideas

Interview: Joël Mesot, Präsident der ETH Zürich

_

Die 1855 gegründete Eidgenössische Technische Hochschule Zürich (ETHZ) ist zu einer weltweiten Referenz geworden. Diese begehrte Position möchte ihr Präsident, der Physiker Joël Mesot, mit allen Mitteln verteidigen. Wir sprachen mit ihm.

Investing Ideas

Interview: Martin Vetterli, Präsident der ETH Lausanne

_

Martin Vetterli, der Präsident der École Polytechnique Fédérale de Lausanne (EPFL), zeigt sich besorgt über Budgeteinschnitte bei seiner Hochschule. Wir haben mit ihm gesprochen.

Investing Ideas

3 Fallbeispiele

_

Der Ausschluss der Schweiz aus europäischen Programmen hat ganz konkrete Auswirkungen auf Forschung und Bildung. Drei Fallbeispiele.

Investing Ideas

Nachhaltig investieren: Wie geht das?

_

Anleger können mit ihren Investitionen dazu beitragen, die Folgen des Klimawandels abzumildern. Hier ein Überblick, welche Möglichkeiten zur Verfügung stehen.

Investing Ideas

Mit Anlagen die Welt retten?

_

Investoren können dazu beitragen, den Planeten vor der Klimakatastrophe zu bewahren. Das ist das Versprechen sogenannter verantwortungsbewusster Investments. Trotz einer Abschwächung in den Jahren 2022 und 2023 dürften diese Anlagen rasch wieder zulegen und bis 2030 auf 200’000 Mrd. Dollar steigen – das ist viermal mehr als heute. Illusion für die einen, Wundermittel für die anderen: Sustainable Finance sorgt für hitzige Diskussionen. Doch am schlimmsten wäre es wahrscheinlich, einfach untätig zuzusehen.

Investing Ideas

ESG: Drei Buchstaben stellen die Finanzwelt auf den Kopf

_

An den Kriterien Ökologie, Soziales und Unternehmensführung führt kein Weg mehr vorbei, um die «Nachhaltigkeit» von Unternehmen zu beurteilen. Doch die Bewertungen der Ratingagenturen sind sehr unterschiedlich und für Privatanleger schwer zu durchschauen.

Investing Ideas

Wie KI die Stimmung an den Märkten einfängt

_

Fortschritte der künstlichen Intelligenz ermöglichen eine immer genauere Analyse der Marktstimmung, um Kursentwicklungen vorherzusagen. Haben traditionelle Wirtschaftsindikatoren dadurch ausgedient? Hier die Antwort von Experten.

Investing Ideas

Interview: Richard Peterson, CEO von Marketpsych

_

Der Amerikaner Richard L. Peterson ist Gründer und CEO von Marketpsych, einem Unternehmen, das die Stimmung am Markt mittels künstlicher Intelligenz analysiert. Wir haben mit dem Firmenchef in Kalifornien via Zoom gesprochen.

Investing Ideas

Eine Flut innovativer Indikatoren

_

KI kann neben der Marktstimmung auch zunehmend andere Daten ermitteln, die für Anleger nützlich sind. Ob Kreditkartentransaktionen, Satellitenbilder, Internet-Recherchen oder GPS-Ortung: Alles wird von Rechnern ausgewertet.

Investing Ideas

Biometrie revolutioniert den Alltag

_

Der weltweite Markt für biometrische Anwendungen dürfte seinen Wert in den kommenden Jahren verdreifachen und 2030 nahezu 150 Mrd. Dollar erreichen. Dieser Trend stösst auf Begeisterung und weckt zugleich Ängste.

Investing Ideas

«Es gibt keine unfehlbare Technologie»

_

Biometrie gilt als äusserst zuverlässig, hat allerdings auch ihre Schwächen. Am Idiap, einem Forschungsinstitut in Martigny, testen die Forscher die Sicherheit biometrischer Anwendungen und versuchen, die Sicherheit zu optimieren.

Investing Ideas

Der Weltraum – ein knallhartes Geschäft

_

Die Raumfahrtindustrie könnte bis 2030 die symbolische Grenze von einer Bio. Dollar überschreiten und damit doppelt so viel wert sein wie heute. Dennoch schneiden die meisten Branchenakteure an der Börse schlecht ab. Ist das der richtige Zeitpunkt, um zu investieren?

Investing Ideas

«Wir sind zur richtigen Zeit auf den Zug aufgesprungen»

_

Als Zugpferd des Schweizer New Space möchte sich die Waadtländer Firma Astrocast einen Platz an der Sonne im boomenden Markt des Internets der Dinge sichern. Wir haben mit CEO Fabien Jordan gesprochen.

Investing Ideas

«Der Weltraum muss allen zugutekommen»

_

Emmanuelle David, geschäftsführende Direktorin des EPFL Space Center, verfolgt aufmerksam die Entwicklung des New Space. Im Interview betont sie, dass diese aufstrebende Industrie auch die Nachhaltigkeit im Blick behalten muss. Etwa wenn es um Weltraumschrott und Emissionen geht.

Investing Ideas

Die Welt steht auf Plastik

_

Bis 2060 wird sich der weltweite Kunststoffverbrauch verdreifachen, wenn nichts unternommen wird, um den Trend zu brechen. Und selbst im besten Fall dürfte sich die produzierte Menge fast verdoppeln.

Investing Ideas

Recycling: Sackgasse oder Königsweg?

_

Weltweit werden heute nicht einmal 10 Prozent der Kunststoffe recycelt. Um diese Quote zu erhöhen, müssen noch viele Hindernisse aus dem Weg geräumt werden.

Investing Ideas

Wie «bio» sind Biokunststoffe?

_

Oft werden Biopolymere als umweltfreundliche Alternative zu konventionellen Kunststoffen präsentiert. Sie sind jedoch nicht immer so unbedenklich, wie man annehmen könnte.

Mehr erfahren

Investing Ideas

Diabetes: lukrative Volkskrankheit

_

Immer mehr Menschen erkranken an Diabetes – und damit wächst auch der globale Markt für entsprechende Therapien. Heute macht er 120 Mrd. Dollar aus, bis 2030 dürfte dieser Markt auf fast 320 Mrd. Dollar anwachsen.

Investing Ideas

Digitalisierung - Retter in der Not

_

Sensoren zur Glukosemessung, Insulinpumpen und Closed-Loop-Systeme verbessern die Lebensqualität von Diabetikern erheblich.

Mehr erfahren

Investing Ideas

Antidiabetika für die schlanke Linie

_

Eine neue Medikamentenklasse zur Behandlung von Typ-2-Diabetes lässt ganz nebenbei auch die Pfunde schwinden.

Investing Ideas

"Moderna is more than just the COVID vaccine"

_

As sales decline for its messenger RNA Covid vaccine, US biotech Moderna is ramping up its non-COVID work. For CEO Stéphane Bancel, mRNA technology has a compelling future well beyond the pandemic.

Investing Ideas

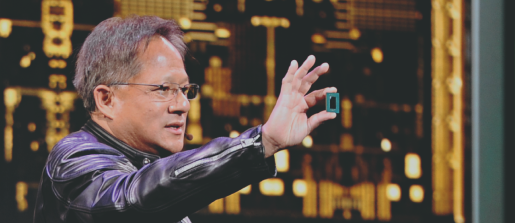

2023: Tech strikes back

_

Tech stocks plunged dramatically in 2022. Time for investors to take a closer look.

Investing Ideas

15 Tech companies with bright futures

_

A point in common among the firms in our selection is that their share price has fallen sharply in 2022, sometimes contrary to economic logic. But they also share a solid business model and a proven track record.

Investing Ideas

"The fall in our share price didn't really worry me"

_

Logitech CEO Bracken Darrell, at the helm of the company for 10 years, outlines the future options the Swiss company is exploring.

Investing Ideas

Goodbye growth

_

The US Federal Reserve has shaken up the markets by making several interest rate hikes since the start of the year to combat inflation. The dollar is soaring, while the euro and sterling have declined. The threat of recession looms.

Investing Ideas

Who’s afraid of the strong swiss franc? Not swiss firms...

_

As the euro nosedives, Switzerland’s national currency is holding strong. And without any complaints from Swiss industry. At least not yet.

Investing Ideas

The forex market is heating up

_

The current fluctuations in the currency market are piquing interest from traders. We provide an overview of the main investment strategies.

Investing Ideas

Batteries powering the world

_

An essential link in the energy transition, the battery industry is booming. The sector is expected to generate more than $300 billion a year by 2030, three times more than today.

Investing Ideas

The race to build gigafactories has begun

_

Over the long term, small caps perform better than large firms on the stock market. We take a closer look...

Learn more

Investing Ideas

Today’ companies powered by batteries

_

The global battery business is dominated by Asian firms. But a handful of US and European companies are trying to carve out a spot for themselves by putting innovation first. Here is an overview...

Learn more

Investing Ideas

Small in size but not in strength

_

The battery market is dominated by Asia, which accounts for more than 85% of global production, but Europe is hustling to make up for lost time.

Learn more

Investing Ideas

Big profits from small companies

_

Small cap companies have their own unique characteristics. Here are seven tips for profitable investments.

Learn more

Investing Ideas

“Being listed is a sign of a serious player”

_

French small cap genOway’s market performance has been turbulent since its IPO. Its CEO and founder Alexandre Fraichard explains.

Learn more

Investing Ideas

A brutal come-down expected for Europe

_

The war in Ukraine will have lasting effects on the global economy – how extensive those effects will be is currently unknown. While markets have returned to their pre-crisis levels, the shadow of stagflation weighs heavily on Europe.

Learn more

Investing Ideas

The energy transition accelerates

_

The supply of raw materials in Europe is going to radically change. Explanations from Clive Burstow, a mining industry specialist at Barings

Learn more

Investing Ideas

Vetropack, a factory under siege

_

The Ukrainian site of the Swiss glass packaging manufacturer has been heavily damaged in the war. Johann Reiter, CEO of the group, granted us an interview.

Learn more

Investing Ideas

Swiss companies facing the war

_

The economic consequences of the conflict in Ukraine vary for Swiss companies. Here is an overview...

Learn more

Investing Ideas

Investing in Femtech

_

While still considered a niche market for most investors, technologies associated with women’s health affect half the global population... A good reason to invest.

Learn more

Investing Ideas

The weight of taboos

_

The subjects covered by femtechs are subject to censure from web giants, which are particularly puritanical when it comes to women's health.

Investing Ideas

Innovation to the rescue

_

For More and more women’s health tech companies are traded on the stock market. Here is our selection.

Investing Ideas

"Switzerland can become a leader in femtech"

_

Tech4Eva, a startup accelerator programme focused on women’s health, has supported 30 companies in raising 60 million Swiss francs. Interview with its director Lan Zuo Gillet.

Investing Ideas

A data-driven market

_

Femtechs use the data they collect to develop ever more innovative services for women. But the buying and selling of such private information for commercial value is cause for concern.

Investing Ideas

Excitement is building

_

Financial markets have been hitting one record after another over the past few months. Will the stock market marathon continue in 2022? Analysts are more divided than ever. We take a closer look.

Investing Ideas

"The virus has accelerated current trends"

_

Aswath Damodaran, professor of finance at New York University Stern School of Business, breaks down the major trends that will affect markets in 2022 and investment opportunities. Find out more in this interview.

Investing Ideas

Top 25 firms to watch

_

For Swissquote Magazine, several analysts agreed to reveal their favourite stocks for 2022. The selection is obviously subjective, but investors should watch closely all the same.

Investing Ideas

Music, a beaming industry

_

Now that concerts are back on and streaming continues to attract more users, 2022 is shaping up to be a record year for the music industry. That’s a tremendous turnaround for a sector that was languishing just 10 years ago.

Learn more

Investing Ideas

The companies setting the tempo

_

After years of sluggishness, the music industry has returned to growth. A turnaround that benefits many companies. Our selection.

Investing Ideas

"It’s important to talk about money"

_

With an international career spanning 40 years, the Swiss singer has experienced the music industry revolution from the inside. He therefore understands all its inner workings. In this interview, he speaks openly and honestly with Swissquote Magazine.

Investing Ideas

"Technology is essential for managing artists"

_

The music industry insurgent Believe wants to wield its expertise in algorithms to compete against record company majors. We interviewed the young label’s CEO, Denis Ladegaillerie.

Investing Ideas

The $500 billion business of sleep

_

Sleep is becoming a major concern as our society grows ever more tired. Now a myriad of tech companies are launching apps and connected objects that promise to bring us more restful nights.

Investing Ideas

Companies that want to put us to sleep

_

A plethora of companies share the lucrative sleep market and interest in the sector is growing from a number of tech firms. Here is our selection.

Investing Ideas

"We want to become a world leader"

_

Specialising in the treatment of obstructive sleep apnoea, the Belgian medtech startup Nyxoah made a stunning entry on the Nasdaq in July of this year. We interview its CEO, Olivier Taelman.

Investing Ideas

Digital Awakening in the Old Continent

_

Lagging behind in digital technology, Europe became fully aware of its dependence on US and Asian digital tech firms during the pandemic. It’s time for revolt.

Investing Ideas

25 high-potential European startups

_

In these days when digital technology is taking over the world, Europe can no longer depend on turnkey services provided by the United States. And its companies are ready to step up to the challenge. Here is our selection.

Investing Ideas

Can deep tech companies rescue europe?

_

Europe is in a strong position to develop the digital technologies of the future. But it will have to protect the startups that create them.

Investing Ideas

"Europe can catch up"

_

Alexandre Pauchard, the new CEO of CSEM (Swiss Centre for Electronics and Microengineering), shares his perspective on the Old Continent’s weaknesses in digital technology, while being optimistic about the future.

Investing Ideas

Blue gold, the new el dorado

_

Due to a strong increase in global demand combined with limited resources, the water market has a bright future ahead of it. Currently worth more than $800 billion, the sector is expected to grow by at least 6% per year.

Investing Ideas

Intriguing companies in the water industry

_

The water market is in the hands of various companies active in very different industries, including building infrastructure, micro-pollutant detection and wastewater treatment. We take a closer look at them.

Learn more

Investing Ideas

«By putting a price on water, we give it value»

_

Is betting on the value of water on the stock market ethical and wise? Mike Young, the man behind the concept, explains.

Learn more

Investing Ideas

Desalination: drinking seawater

_

Removing salt from seawater to combat water scarcity is one solution that is gaining traction. But the technologies involved have serious environmental consequences.

Learn more

Investing Ideas

«Colossal investments are planned in the United States»

_

Boasting longstanding expertise in the water market, Dieter Küffer, senior portfolio manager at Robeco, describes the latest trends in the sector.

Learn more

Investing Ideas

The genetics business is booming

_

The cost to analyse the human genome has plummeted, opening the door to many medical and also

recreational applications. We examine a phenomenon combining science, business and ethics...

Learn more

Investing Ideas

Winners of the genome revolution

_

Offering direct-to-consumer genetic testing, gene therapies, and even incredible IT storage solutions, the DNA business continues to grow. A myriad of companies are taking advantage of it. Here’s an overview.

Learn more

Investing Ideas

"Messenger RNA could be used to treat any illness"

_

As Switzerland approves two COVID‑19 vaccines that use messenger RNA, Steve Pascolo – a researcher at University Hospital Zurich, an industry pioneer and a busy entrepreneur – explains the potential for these new types of therapeutic solutions. Find out more in this interview.

Learn more

Investing Ideas

Dividends: time for recovery

_

After a disappointing year, dividend pay-outs to shareholders are expected to increase in 2021. But the banking industry remains beholden to government decisions.

Learn more

Investing Ideas

The five commandments of a good dividend strategy

_

Over the last 10 years or so, the shares of companies offering high dividend yields have underperformed the market. But by building a selective value portfolio, investors can still come out ahead. We take a closer look.

Investing Ideas

The Swiss exception

_

Swiss companies differed from their European neighbours in 2020 with their generous dividends.

Investing Ideas

Green Hydrogen: The Fuel of the Future

_

With the technology on its way to becoming mature, clean hydrogen investment projects are booming.

And share prices of companies active in this industry are skyrocketing.

Investing Ideas

“2020 is a Turning Point for Hydrogen”

_

Oil and gas giants are now investing in the growing hydrogen market. We interview Oliver Bishop, general manager of Shell Hydrogen, a subsidiary of the Anglo-Dutch group.

Investing Ideas

These companies are gassed up and ready to go

_

Hydrogen producers, electrolyser and fuel-cell manufacturers, energy utilities, automotive and rail manufacturers... The hydrogen market is attracting quite a range of companies. Overview.