BATTERIES

Today’ companies powered by batteries

The global battery business is dominated by Asian firms. But a handful of US and European companies are trying to carve out a spot for themselves by putting innovation first. Here is an overview...

By Bertrand Beauté

The Dutch company markets giant batteries that store electricity produced by solar and wind farms. They can also be used to supply electricity for events and work sites. For example, Alfen is currently building the third-largest storage solution in Finland for a wind farm. The company, which also manufactures electric vehicle charging stations, expects its revenue to increase by at least 30% in 2022.

BYD, for "Build Your Dreams", is the story of the dizzying rise driven by the dream of a man of vision. Founded in 1995 by the no-fuss engineer Wang Chuanfu, the company initially specialised in manufacturing nickel-cadmium and lithium-ion batteries. The boom in mobile phones and laptops in the early 2000s quickly led the company to prosperous days. It offered batteries at rock-bottom prices, putting them in Nokia mobile phones, Dell computers and Black & Decker tools. Today, BYD batteries still power one in 10 phones sold worldwide, and the company’s customers include giants such as Samsung, the world’s largest smartphone maker.

But that was not enough for Wang Chuanfu. Instead of resting on his laurels, the ambitious CEO sensed the future of automotive technology. In 2003, he bought Qinchuan Auto, a small, struggling manufacturer of petrol-powered cars. BYD’s experience gave it a critical advantage in the budding electric car industry.

In September 2008, as Wall Street was collapsing under the subprime crisis, Warren Buffet bought a 10% stake in BYD for $232 million. The American investment icon never regretted that choice. Benefiting from Beijing’s EV subsidies, BYD has become the world’s third-largest electric car manufacturer, behind Tesla and SAIC, and the third-largest battery manufacturer behind its compatriot CATL and the Korean LG Energy.

However, Tesla and BYD have never really interacted with each other. While the US firm tackles the global market with premium vehicles, so far BYD has zeroed in on its domestic market with inexpensive models. But that could change. Since opening its Shanghai factory in 2019, Tesla has increasingly focused on the Asian market, while BYD is moving in the opposite direction. Active in Norway since 2021, the Chinese brand plans to tackle the European market as a whole starting at the end of 2022. This strategy has now been approved by investors. Over the last three years, BYD shares have risen by more than 500% and most analysts are still buying.

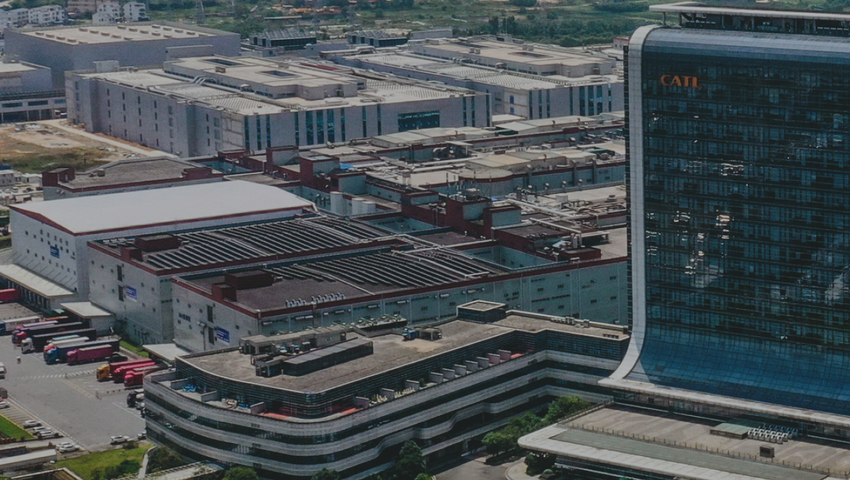

The news came as a surprise. Though it has not yet completed construction of its first factory on the Old Continent (in Erfurt, Germany) the world leader in battery technology – Contemporary Amperex Technology, better known by its acronym CATL – announced in mid-August that it would be building a second gigafactory in Europe, in Debrecen, Hungary. This massive investment, tagged at €7.3 billion, is CATL’s way of baring its teeth. The Chinese firm has no intention of leaving any market share to European newcomers, such as the Swedish Northvolt or Automotive Cells Company (ACC), a joint venture between Stellantis, Mercedes and Total, which are all launching plans to build enormous plants in Europe.

In barely 10 years of being in business, CATL has grown into a heavyweight with no cap on ambition. Since it was founded in 2011, the company has enjoyed massive support from the Chinese government. First came the "Made in China 2025" plan in 2015, which placed electric vehicles as a strategic area, followed by Beijing’s exclusion in 2016 of Japanese and Korean producers from the Chinese battery market.

As a result, CATL took advantage of the strong growth in sales of local manufacturers such as Nio, XPeng and Li Auto. These Chinese challengers to Tesla are now all its customers. With 10 factories and five R&D centres, the company has also managed to list as a supplier to Western firms such as Tesla, Mercedes- Benz (Daimler), Volkswagen and Volvo. CATL now has more than 30% of the world market and half of the market in China, edging out significant economies of scale over its competitors. This break-neck growth has not gone unnoticed by investors: CATL’s share price has increased tenfold since its listing on the Shenzhen Stock Exchange four years ago. Most analysts recommend buying shares as the company has a head start on all its competitors.

Batteries are used in more than just electric cars. And as a result, French company Forsee Power manufactures batteries for buses, construction machinery, agricultural equipment and two-wheeled vehicles. In June, the company, which has production facilities in Poland, China and India, announced its plans to invest €13 million to build a factory in the United States.

The Geneva-based sensor manufacturer is benefiting from global electrification. Little known to the general public, LEM products can be found in electric vehicles, wind turbines and charging stations. For batteries, LEM Holding manufactures products including several sensors that allow Battery Management System software to function.

The geopolitical crisis between Beijing and Washington might just find a lucky winner in the battery sector: LG Energy Solution. Currently number two in the sector behind the Chinese firm CATL, in recent months the Korean player has signed multiple contracts and partnerships with Western firms. Big names including Tesla, Hyundai, Volkswagen, General Motors, Stellantis are anxious to reduce their dependence on Chinese suppliers for components such as batteries or semi-conductors.

To finance its growth, LG Energy Solution, a subsidiary of the LG Chem conglomerate, pulled off a successful launch onto the Seoul Stock Exchange in January 2022, raising the equivalent of $10.7 billion along the way in what was the country’s largest ever IPO. Originally listed at 300,000 Korean won, the stock is now trading at around 445,000 won, jumping almost 50%.

While its primary competitor CATL relies mainly on its Chinese production sites and is currently completing its first plant outside the country in Germany, LG Energy already has gigafactories the world over, including in the United States, Europe, Australia, China and Korea. This distribution means its customers can be served at home and enjoy access to a local network. In addition, LG sets itself apart with its more advanced ESG (Environment, Social and Governance) approach than that of its Chinese competitors. For example, in July 2022 the company set up a joint venture in China with Huayou Cobalt to recycle its end-of-life batteries. In 2021, LG Energy generated revenue of $15 billion, up 42% year over year. Most analysts have shown their support for the group’s strategy with a buy recommendation.

The traditional battery supplier to Tesla, the Japanese conglomerate announced on 14 July that it would invest $4 billion to build a new factory in Texas. The goal is to increase production capacities in order to remain the primary supplier to Tesla, which is now also turning to LG Energy Solution and CATL.

The Korean chemicals firm produces NCM (nickel, cobalt, manganese) and NCMA (aluminium) cathodes for electric vehicle battery manufacturers, as well as graphite anodes. The company, which accounts for approximately 20% of the global cathode market, plans to increase its cathode production capacities from 43,000 tonnes per year currently to 610,000 tonnes in 2030.

"The future is solid," writes QuantumScape on its website. The US company firmly believes that the battery of the future will be solid, whereas the current lithium-ion models contain a liquid electrolyte. The startup, founded in 2010, hopes to be the first on the market. That’s because on paper, the technology to create solid batteries would be a huge step forward. According to QuantumScape, their energy density could reach 400 Watt-hours per kilogram (Wh/kg), compared to 250 Wh/kg for the highest performing traditional lithium-ion counterparts. This would give nearly double the driving range, as well as provide a fast charging time, as 80% of the battery could be recharged in under 15 minutes. Another advantage is that unlike liquid models, solid batteries are safer due to not being flammable. A revolution for the electric vehicle market.

QuantumScape plans to produce solid battery cells for trial runs in vehicles by next year and hopes to move to large-scale commercialisation by 2024. This ambitious timeline has attracted both Bill Gates and Volkswagen. In 2020, the German manufacturer invested $200 million in the California-based company, after an initial investment of $100 million.

But there are still many obstacles to overcome before solid batteries become a reality, particularly the cost. According to several experts, a solid battery would be three to five times more expensive than a traditional model, restricting them to premium applications. Furthermore, QuantumScape has tough competition in the race for solid batteries, up against a multitude of startups including Solid Power from the US and ProLogium from Taiwan, as well as giants such as Toyota, CATL and LG Energy Solution. Analysts are cautious. Almost all recommend holding shares.

The German company specialises in developing and manufacturing carbon products. SGL’s activities include supplying graphite (a form of carbon), which allows lithium-ion battery manufacturers to produce their anodes. This is a booming market, which led SGL to increase its production capacities in 2021 for graphite used in anodes.

The timeframe seems optimistic, to say the least. A specialist in solid batteries – a type of battery that is promising but still being developed – US startup SolidPower began its pilot production line in 2022 and plans to validate its concept with its partners (BMW and Ford) in 2023 before moving to mass production as early as 2024. The company must compete with other startups such as QuantumScape, as well as giants such as Toyota and CATL.

Umicore is an uncontested leader in green finance. Specialising in metal recycling, the Belgian firm is growing into a major player in end-of-life battery management – a nascent market with a promising future as electric vehicles become more mainstream.

In June 2022, Umicore announced plans to build the world’s largest recycling plant in Europe. With capacity to treat 150,000 metric tonnes of battery material per year, this intended result of a $525 million investment is scheduled to open in 2026. "It means moving up a gear," said Kurt Vandeputte, vice president of Battery Recycling Solutions at Umicore, during the presentation. "We’re going to do it in Europe first, then in the United States."

But this seemingly bright future is overshadowed by the company’s long history. In the early 20th century, the firm, at the time named Union Minière du Haut Katanga, directly operated copper mines in Katanga, in what is now the Democratic Republic of Congo. Independence, followed by nationalisation of the mines in 1966, pushed the company to redeploy elsewhere. Union Minière then operated a zinc mine in Saint-Félix-de-Paillières, France. The company has since moved out of the site, but it left behind highly polluting waste buried under the vegetation.

Cancer-causing arsenic, lead, zinc, cadmium, antimony and copper continue to haunt the soil and water. Umicore, forced by the public authorities, has been cleaning up the site since 2016 and is not done.

But that’s not the only site, or problem. In Olen, Belgium, the company dumped behind it a 500,000-cubic metre mountain of radioactive waste. In a statement, Umicore said it "continues to work on environmental improvement projects and requests consultation with authorities on a robust methodology." This presents a dilemma for the Belgian government: forcing the company to clean up would cost billions, and Umicore would probably go bankrupt. But if the company doesn’t pay, the taxpayer will foot the bill. In the meantime, analysts are very divided on the stock, with some issuing a buy recommendation and others a sell.

Along with Duracell, Varta is undoubtedly one of the best known brands of microbatteries in the world. Operating in 75 countries, the century-old German firm is flooding the planet with rechargeable batteries, which can be found in numerous devices including car keys, DIY tools, torches and other consumer appliances. With five production sites in Germany, Romania and Indonesia, the company has no plans of depriving itself of the burgeoning large battery sector. Alongside its traditional business in rechargeable batteries, Varta has therefore launched into the building battery segment, used for example to store electricity produced by solar panels on a house. Tesla is also present in this sector with its Powerwall.

Varta’s fast-growing "Household Batteries" segment generated €388.6 million in 2021, gradually catching up with the "Microbatteries" segment, currently worth €514.4 million. This performance has made the group hungry for more. In 2021, it announced the development of the V4Drive battery cell for premium electric vehicles. This outlook has attracted investors: since its return to the Frankfurt Stock Exchange in 2017, Varta’s share price has risen by more than 300%.

But the crisis in Ukraine could sap the energy out of Varta. Rising commodity prices and inflation have prompted the company to revise its forecasts downwards. In 2022, Varta’s revenue is forecast at between €880 million and €920 million, down from its €1 billion target set at the beginning of the year. Most analysts recommend holding shares all the same.