Dividends: time for recovery

After a disappointing year, dividend pay-outs to shareholders are expected to increase in 2021.

But the banking industry remains beholden to government decisions.

Bertrand Beauté

15.12.2020

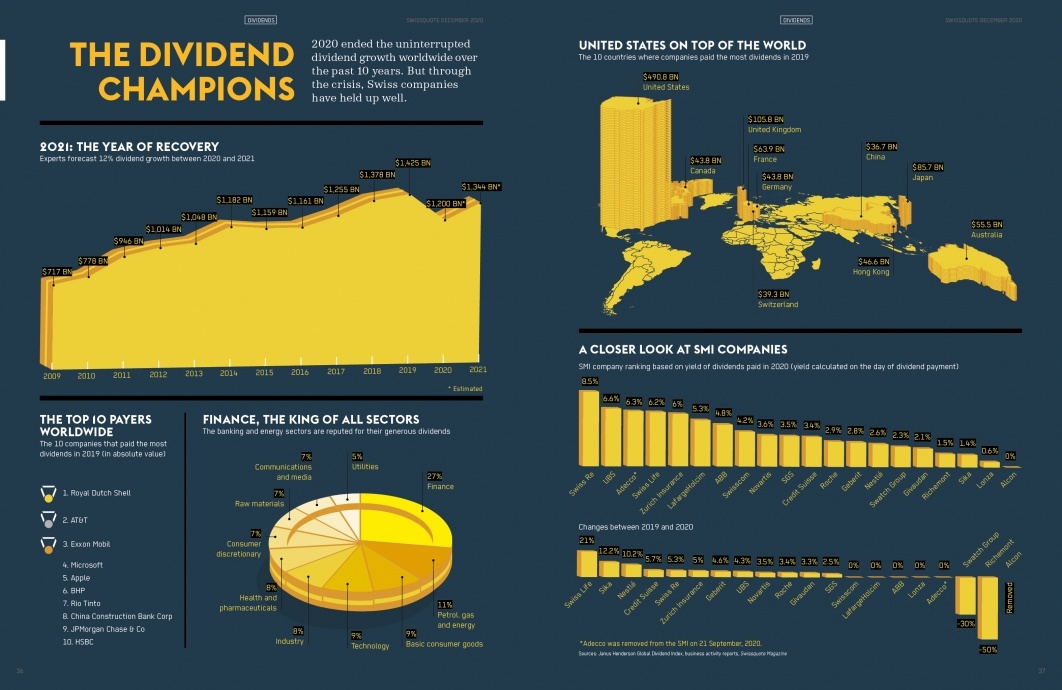

Shareholders are on a diet. During 2020, investors received limited dividends. According to the Janus Henderson Global Dividend Index report, pay-outs from publicly listed companies fell 45% in Europe (excluding the UK) in Q2 2020 – the most important period in Europe for dividends, since most companies pay out once between April and June. The total amount paid out was $83.4 billion, compared to $150.3 billion a year earlier. Faced with the coronavirus crisis, European companies decided – sometimes under pressure from their government – to reduce the amount of dividends paid to shareholders: 54% of companies reduced or eliminated dividends paid in 2020 for the 2019 financial year.

While there was a wide range of reductions depending on the country (dividends dropped 70% in Spain, compared to only 19% in Germany), there was one outlier: Switzerland was the only country in Europe where dividends remained stable between 2019 and 2020. In the United States, where shareholder dividends are usually paid out several times throughout the year, the situation is just as dire. Between September 2019 and September 2020, dividends paid by companies on the S&P 500 decreased by $39.7 billion compared to the same period one year earlier, according to S&P Dow Jones.

In a best-case scenario overall for 2020, dividends paid around the world are expected to decrease by 17% to reach $1.180 trillion compared to $1.430 trillion in 2019, according to estimates by the Janus Henderson Global Dividend Index. “2020 will be the worst year for dividends since at least the Global Financial Crisis,” wrote the authors of the report. “With the pandemic, 2020 was a truly difficult year,” said Nicolas Simar, senior portfolio manager of Euro and European High Dividend strategies for the Dutch asset management company NN Investment Partners (NNIP). “Like in any recession, company profits shrunk significantly, leading to a 25% to 30% decrease in dividends across Europe.”

As the second wave of the coronavirus unfurls across the world, will 2021 be even more catastrophic, given that dividends are based on a company’s 2020 profits, i.e. business during the pandemic? “Dividend amounts will not plummet,” predicts Jérôme Schupp, analyst at Prime Partners. “Stability is very important in this situation, because lowering dividends is perceived very negatively by shareholders. It gives the impression that the company doesn’t have confidence in the future. During the 2008 crisis, for example, companies generally maintained their dividends, and some even paid out more than their annual profit.” Eleanor Taylor Jolidon agrees: “Cutting dividends sends a bad message”, said the UBP fund manager. “Few companies will resort to that unless they are forced to.”

According to experts, dividends allocated to shareholders in 2021 are expected to increase in Europe by nearly 15% compared to 2020. “We’re living through a profound crisis and it will probably be two years before dividends return to their pre-pandemic levels,” said Simar. “But I do see several promising factors.” Unlike the 2008-2009 crisis during which governments implemented austerity measures, this time governments implemented very coordinated recovery plans with both tax and monetary implications. These plans should enable the economy, and therefore dividends, to recover more quickly. Especially because the positive news from vaccine candidates provide a bit of hope that the health crisis will soon improve.

“Many companies that were financially able to pay out dividends in 2020 chose to not pay them out of caution or necessity,” said Simar. “Dividends should be back in 2021.” In France, for example, telecoms operator Orange already decided to raise its dividends to pre-pandemic levels, or 70 cents per share, for 2021. It reduced dividends by about one-third in the spring. Another example is Italian insurer Generali: on Thursday 12 November, it announced it would pay shareholders in 2021 “pending a favourable position from the regulator”. It had to suspend all dividends this year, under pressure from the European Insurance and Occupational Pensions Authority, which was concerned about the impact of coronavirus on the industry. The situation was a similar for AXA. “According to the group’s profitability, solvency and liquidity, it should have no problem paying dividends next year,” declared Etienne Bouas-Laurent in early November. Bouas-Laurent is CFO of the French insurer, which halved its dividends this year.

But the industry under the most scrutiny will most certainly be banking. In March 2020, the European Central Bank (ECB), which supervises the sector, strongly recommended that financial institutions in the eurozone freeze dividend pay-outs and share buyback programmes until 1 October 2020 – which has since been pushed back to 1 January 2021. The goal is to “preserve banks’ capacity to absorb losses and support the economy in this environment of exceptional uncertainty”.

While it was not a formal requirement, “it was difficult, if not impossible, for big companies in the industry to contradict the regulator,” said Martin Moeller, co-head of the Swiss & Global Equity Portfolio Management at Union Bancaire Privée (UBP). “In fact, the big banks that were traditionally generous with dividends, such as Deutsche Bank in Germany, had to stop paying out to shareholders.” Two-thirds of European banks, including BNP Paribas, Natixis and Societe Generale, suspended their dividends in line with ECB recommendations, and withheld €27.5 billion in pay-outs for the 2019 financial year. According to the Janus Henderson Global Dividend Index, half of the dividend reductions in Europe (excluding the UK) in 2020 were the result of restrictions imposed on the banking industry.

But an increasing number of European banks, such as HSBC, Santander and BNP Paribas, want to bring back dividends in 2021. While their fate rests in the hands of the ECB, which will decide in December whether or not to continue its recommendations, Nicolas Simar believes banks will likely see a case-by-case approach: “Banks with the most solid balance sheets and significant equity will likely be able to pay out dividends starting in 2021.”