Andrew Hallam

28.10.22

Should You Try To Protect Your Wealth When Stocks Crash?

_

When Odysseus, the protagonist in Homer’s Odyssey, plunged a burning log into a giant cyclops’ eye, he saved himself and his crew. Homer demonstrates that swift, brave action is sometimes necessary. As global markets fall, could some kind of action save your portfolio?

In another Greek story, the tragic hero, Oedipus commits to an act that results in stomach-churning consequences. He begins a quest to find his birth parents. While on that journey, a man coming from the other direction blocks his path. Neither man is willing to step aside, so they fight. Oedipus kills that man and a short while later, marries that man’s wife.

Years later, Oedipus learns that the man he killed was his father. He’s also horrified to learn that he married his mother. And yeah, it gets creepier. The couple had children.

Sophocles, the playwright who created Oedipus Rex, demonstrates that hasty action can have dire consequences. And his 2000-year old lesson is timeless for investors.

This brings us back to Odysseus. He and his shipmates were trapped in a cave. The cyclops blocked the exit. Each day, the one-eyed monster picked up a couple of men, tossed them against the rocks and gobbled them up. If the men did nothing, they would have all been eaten. Death by cyclops. That’s permanent.

The stock market’s level, however, is a temporary point in time. It always has been. And it always will be. In other words, the market’s current price point is never permanent.

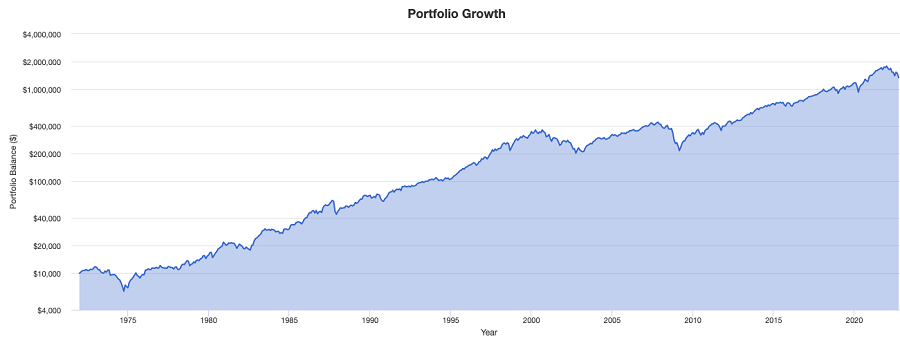

Note the chart below. It represents the US stock market from January 1972 until September 30, 2022. Notice the drops along the way. Each of those dips was a different point in time. But none of those dips was a cyclops in a cave. In other words, no monster ate investors who failed to act. In fact, if investors remained cool and continued to add money during market drops, they would have lowered the average price at which they were paying. And when markets recovered (as globally diversified portfolios always do) patient investors reaped large rewards when stocks hit new heights.

But I can hear what you’re thinking: You don’t want your portfolio value to drop…ever.

To mitigate losses, should you switch into some high dividend paying stocks? Should you buy a real estate income trust? Should you sell your investments, put money into cash and then dump it back into stocks when (or just before) markets recover?

Action. You want action.

But investment action, instead of patience, brings us back to Oedipus. I’ll explain using data from some of the world’s smartest investment minds: hedge fund managers. They try to curb losses during market drops…or even make money when stocks fall. Who wouldn’t want that?

However, like Oedipus, their actions come back to haunt them. Or at least, they haunt people who let hedge fund managers speculate on their behalf. By strategically moving money around when stocks fall, hedge funds miss big gains when stocks recover.

As a result, $10,000 invested in U.S. hedge funds on January 1, 2003 would have grown to just $15,072 by October 4th, 2022. In sharp contrast, a $10,000 investment in a global stock index would have grown to $51,742 over the same time period.

We can blame hedge fund fees for part of their poor performance. But the biggest blame lies in strategic tinkering.

Global Stock Market Performances versus U.S. Hedge Funds

January 1, 2003 to October 4, 2022

| Year Ended Dec 31 | Global Stock Return | Growth of $10,000 in Global Stock Market Index | HFRX Hedge Fund Returns | Growth of $10,000 in US Hedge Funds |

|---|---|---|---|---|

2003 | 38.08% | $13,808 | 13.40% | $11,340 |

2004 | 18.27% | $16,330 | 2.70% | $11,646 |

2005 | 11.52% | $18,212 | 2.70% | $11,960 |

2006 | 23.11% | $22,420 | 9.30% | $13,072 |

2007 | 11.16% | $24,922 | 4.20% | $13,622 |

2008 | -41.72% | $14,525 | -23.30% | $10,448 |

2009 | 30.40% | $18,940 | 13.40% | $11,848 |

2010 | 8.62% | $20,573 | 5.20% | $12,464 |

2011 | -7.99% | $18,927 | -8.80% | $11,367 |

2012 | 18.34% | $22,398 | 3.51% | $11,766 |

2013 | 26.59% | $28,354 | 6.72% | $12,577 |

2014 | 2.02% | $29,927 | -0.58% | $12,484 |

2015 | -0.44% | $29,795 | -3.64% | $12,029 |

2016 | 6.53% | $31,740 | 0.86% | $12,133 |

2017 | -2.25% | $31,026 | 0.73% | $12,221 |

2018 | 18.52% | $36,772 | -6.70% | $11,647 |

2019 | 28.21% | $47,146 | 8.62% | $12,651 |

2020 | 15.83% | $54,609 | 13.40% | $14,346 |

2021 | 18.57% | $64,750 | 10.30% | $15,824 |

2022 (to October 4th) | -21.09% | $51,742 | -4.75% | $15,072 |

SOURCE: Morningstar Direct; HFRX Hedge Fund data

This brings us to today and a lesson worth learning.

Hedge fund managers are trained to read the market. But they still fail far more than they succeed.

You aren’t likely as skilled as a hedge fund manager. Yet, with markets dropping, you still might be tempted to tinker with your money. Evidence, however, says that’s bird-brain crazy.

Market levels, after all, are temporary. But if you stop adding money during market drops, or move out of a globally diversified portfolio, or make tactical changes to mitigate losses, here’s what will happen:

Your money won’t strongly rise when stocks recover.

That’s not as bad as death by Cyclops. But as shown in the table above, it will permanently hamper your wealth.

That’s why you should be patient…unlike Oedipus Rex.

Andrew Hallam is a Digital Nomad. He’s the bestselling author Balance: How to Invest and Spend for Happiness, Health and Wealth. He also wrote Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.