Andrew Hallam

19.10.23

When Investing In Stocks Or ETFs, Should You Use Market Orders or Limit Orders?

_

The biggest risk to good investment returns isn’t the economy. It isn’t the stock market. It isn’t a politician, either. The biggest risk we face is the person we see in the mirror each day. We, after all, are human. That means we’re affected by our own fear and greed.

When investing, this can cause us to do silly things. We often chase what’s “hot” only to fall on our faces later. We fear investing during turbulent times. We love investing when things appear rosy. In other words, we sabotage our results by, far too often, buying high and selling low.

1. Build a globally diversified portfolio of low-cost ETFs

2. Never speculate–and don’t let anyone speculate on your behalf.

3. Add money whenever you have it.

That’s it. Follow these simple rules and, over your lifetime, you’ll beat the performance of most hedge funds. You’ll thump most college endowment funds. You’ll earn better lifetime returns than your day-trading buddies who might talk a great line.

But there’s a pesky little devil that likes to tempt us all.

This little demon often juggles our emotions when we’re about to place an order to purchase or sell. We often wonder, is this a good price? When investing, we can place one of two types of orders: a limit order or a market order.

When we place a market order, we’re accepting the current market price. But that doesn’t mean we’ll pay that market price. By the time the order goes through, we might pay slightly more or slightly less than the last posted price.

Such orders are simple to make. We place them. Then we walk away. Our job is done. But are these the best orders to make?

Limit orders, instead, are the sort I recommend. But how can you best use them? Theoretically, you could see your ETF trading at $45 per unit. You might decide to place a limit order to pay $40. If you set the order to cover that day, and the price hits $40 or lower, you will pay $40 per unit, and not $45.

It sounds good, right?

Unfortunately, if the price doesn’t hit $40, your order won’t go through. The following day, you could log into your account to try to make that purchase again. But this time, the ETF might open at $46. If you, once again, play games with limit orders, you might be looking at an ever-increasing price. The ETF might rise to $47, and you still haven’t bought it. In fact, it might never come back to $45 again.

Such limit orders are a form of gambling. And if you want to give yourself the highest statistical odds of doing well in the markets, kick this temptation.

Get International Investing insights

in your inbox once per month

It’s the kind of speculation that can cost investors money. In the August 2010 edition of The Journal of Finance, Juhani T. Linnainmaa published, "Do Limit Orders Alter Inferences about Investor Performance and Behavior?”. The researcher found that investors who use market orders usually do better than investors who place limit orders.

But market orders come with risks. Occasionally, markets (or individual stocks or ETFs) have been known to temporarily spike or crash. This is rare. But it happens. For example, assume you are rebalancing your portfolio to maintain a consistent allocation. You place a market order to sell a specific ETF. But then a flash crash (literally lasting seconds) occurs. An ETF that was trading at $45 might momentarily fall to $18, right at the point of your market sale.

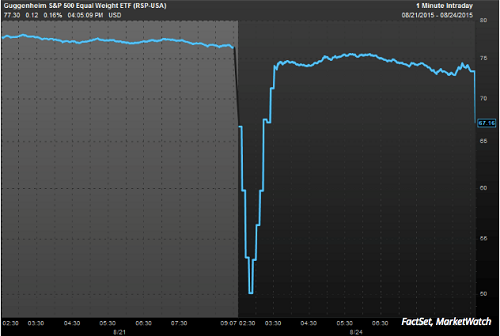

Here’s a real-life example. Assume an investor owned Guggenheim’s S&P 500 Equal Weight ETF (RSP). If such an investor placed a market order to sell shares on August 24, 2015, they could have been in for a shock. At one point during the day, it fell 43 percent. This was a flash, market glitch. As shown in the chart below, it recovered about half an hour later.

Guggenheim’s S&P 500 Index Fell Hard During The Day

But a market order to sell could have cost investors a lot of money.

How Do We Place Smart Limit Orders?

When I purchase my ETFs, I look at the current price and then select a limit order. But instead of selecting a limit order price that’s lower than the current price, I select a limit order that’s a few cents higher. For example, if my ETF is trading at $45, I might select something like $45.30 as my purchase price. That doesn’t mean I’ll pay $45.30. If, at the time the order goes through, that ETF is priced at $44, that’s the price I would pay: $44.

If a computer/market glitch temporarily shot the price of that ETF to $80, my limit order would save me the pain of paying $80. If such a glitch occurred, my order would go through at the limit I set: $45.30.

I do the opposite when I’m about to sell. Assume my ETF is trading at $45. If I want to sell it, I place a limit order that’s a few cents lower than the current price. I might place that order to sell at $44.50. That doesn’t mean I’m willing to sell below the market price. If, at the time the transaction goes through, the ETF is priced at $45.10, that’s how much I’ll get per unit. Such limit orders protect me from quick, flash crashes.

Mysterious market moves are rare. But they do occur.

That’s why it’s smart to use limit orders.

But instead of using this feature to gamble, we need to do this right.

Andrew Hallam is a Digital Nomad. He’s the bestselling author Balance: How to Invest and Spend for Happiness, Health and Wealth. He also wrote Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.