5.1 Introduction to Risk Management

Learn about the essential methods used to identify, analyze and prioritize risks. Discover the difference between specific and systematic risks and how to mitigate them.

Complete this course

Script

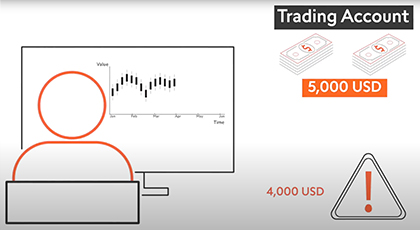

In this short video, we will look at the various kinds of risk that traders encounter. When you invest, there is no guarantee that you will make money. In fact, you might lose money. Therefore, there is risk involved. In response, perceptive traders practice “risk management”, which is the identification, analysis and prioritization of the risk of each trade. Generally speaking, “specific risk” affects only specific assets, for example a single stock, while “systematic risk” affects many assets at a time. For example, many assets are affected by changes in an interest or exchange rate, and by political events or a country defaulting on its financial obligations. In some situations, the market may pose risk in itself, through absence of liquidity to make desired trades, or through extreme or lacking volatility.Traders who treat the risk of financial loss seriously monitor and either accept or mitigate the risk of their investments to suit their personal preferences. While specific risk can be mitigated by diversifying your investment portfolio, you can address systematic risks in various ways. For example, you can limit your trade sizes, hedge or trade only at certain times. Regardless of your risk management strategy, awareness and discipline are key. There are two aspects to discipline – one is personal, and one is practical trade execution. Regarding trade execution, a common mistake among inexperienced traders is to forget to calculate the profit or loss price at which the trade should be closed. Placing automatic trade orders at the desired levels addresses both kinds of trade discipline. Understanding and managing the risk of both each trade and of your portfolio as a whole provides peace of mind and the flexibility to act when opportunity arises.