Andrew Hallam

08.05.2020

Why Bonds Are Like Bicycle Helmets…Especially Today

_

I glanced at the small computer on my handlebars as I flew down the steep hill. I was doing 57 miles per hour on skinny bicycle tires. It was 1987…and I wasn’t wearing a helmet. Back then, serious cyclists only wore helmets when they raced. And most of us wouldn’t have done that, if those weren’t the rules.

I sometimes trained with a Swedish national team cyclist. He crashed his bike while training in 1988 and fell into a comma. That year, another friend met the same fate. I didn’t see them crash, but I knew they were helmetless. Fortunately, both men recovered; they had horseshoes up their butts.

I wish I could say I began wearing helmets after that. But I didn’t. Climbing a steep road with a helmet felt like my head was in a sauna. That slowed me down. I didn’t start to wear a helmet while training until the early 1990s, when helmets became mainstream in Canada.

Bonds are much like those old bowl-shaped helmets. When things are going well, they limit a portfolio’s speed. During a long bull run–such as what we had from 2009 to 2019– bonds were about as popular as toilet bowls on heads. Plenty of people came up with reasons not to own bonds: interest rates were low; bonds always lose to stocks over long time periods. Many figured they could handle stock market volatility, without owning bonds. But what we think we can handle and what we can realistically handle are often two different things.

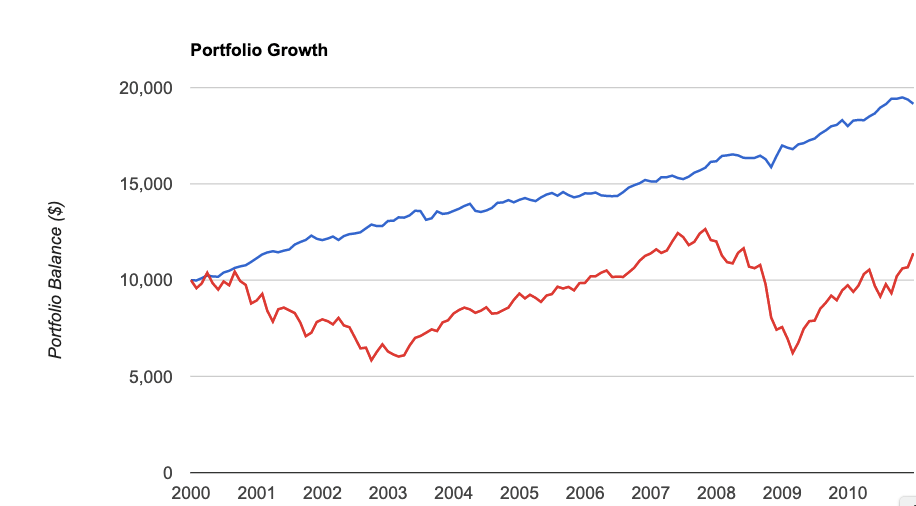

If, for example, stocks fall 50 percent, a portfolio with bonds wouldn’t fall as far. Sometimes, bonds even rise when stocks fall. Over the 11 years ending January 2011, U.S. bonds (in blue below) trounced U.S. stocks (in red). That sometimes happens…for a decade or even longer. Nobody can predict when it will happen next. It’s part of the random walk that all investors should accept.

Bonds Beat Stocks

January 2000-January 2011

* Source: portfoliovisualizer.com, using Vanguard’s Bond Market Index (VBMFX) and Vanguard’s Stock Market Index (VTSMX).

Long term, however, stocks do beat bonds. If people didn’t have emotions, perhaps they wouldn’t need bonds. But according to research by Daniel Kahneman, a Nobel Prize laureate in behavioral economics, people dislike losses twice as much as they like gains. That’s why bonds can help us out. If we build diversified portfolios of stocks and bonds, they can prevent us from freaking out when stocks fall hard.

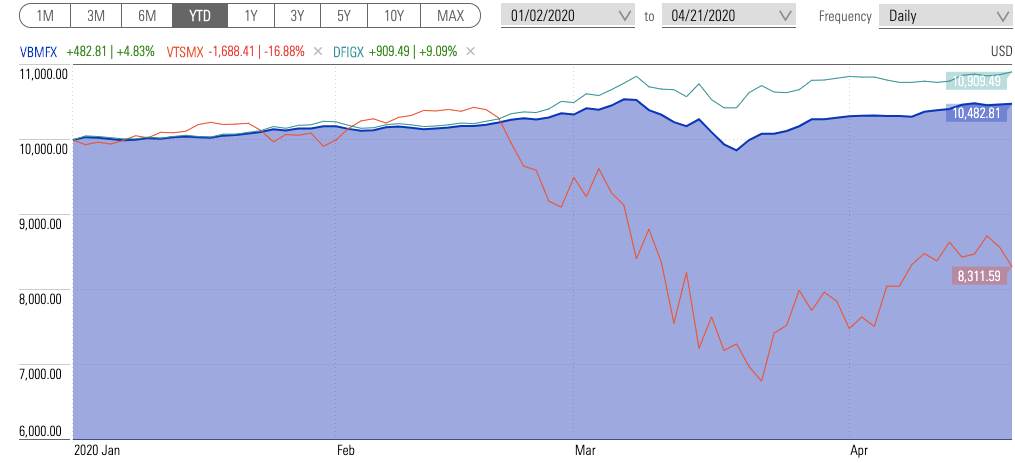

Here’s an example of how bonds can help. From January 1, 2020 to April 21st, 2020, Vanguard’s Total U.S. Stock Market Index (in red below) dropped 16.88 percent. Meanwhile, over the same time period, Vanguard’s Total Bond Market Index (in dark blue) gained 4.83 percent. Dimensional Fund Advisors’ Intermediate Government Fixed Income Fund (in light blue) gained 9.09 percent.

Bonds Protect Investors When Stocks Fall Hard

Source: Morninstar.com, using DFIGX (DFA bond fund), VBMFX (Vanguard Bond fund) and VTSMX (Vanguard U.S. stock market index)

This isn’t some kind of freaky aberration. Over the past fifty years, U.S. stocks had 10 losing years. During each of those years, intermediate government bonds made money for investors.

I’ve listed comparisons for each of those years below.

How Do Bonds Stack Up When Stocks Fall?

| Year | U.S. Stock Returns (including reinvested dividends) | Intermediate Government Bond Returns (including reinvested interest) |

|---|---|---|

| 1973 | -18.18% | +4.47% |

| 1974 | -27.81% | +5.70% |

| 1977 | -3.36% | +1.04% |

| 1981 | -4.15% | +9.41% |

| 1990 | -6.08% | +9.46% |

| 2000 | -10.57% | +14.03% |

| 2001 | -10.97% | +7.55% |

| 2002 | -20.96% | +14.15% |

| 2008 | -37.04% | +13.32% |

| 2018 | -5.26% | +1.0% |

| 2020 (to 4-21-2020) | -15.40% | +4.96% |

Source: portfoliovisualizer.com; Morningstar (for stock and bond market returns January 1, 2020 to April 21, 2020)

This doesn’t mean investors should push money into bonds if stocks have dropped or if they think they’ll fall further. That’s like a cyclist trying to snatch a helmet from a car before they hit the pavement. Smart cyclists always wear helmets. And smart investors include stocks and bonds.

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller, Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.