Andrew Hallam

02.10.2020

Searching the Best Mutual Funds For a Volatile Market?

_

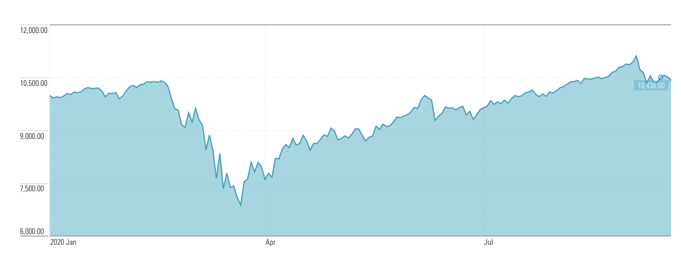

So far, 2020 has been a wild ride for stocks. The S&P 500 gained about 4.2 percent from January 1st to February 19th. Coronavirus fears plunged stocks 34 percent from mid-February to March 23rd. Stocks then soared about 61 percent, hitting a high on September 2nd. Then they dropped 6.2 percent over the following two weeks.

Wild Ride For U.S. Stocks

January 2020 – September 17, 2020

Source: Morningstar.com

Plenty of people might have wondered which funds were the best to buy during a rocky market. The folks at Kiplinger’s magazine touted five such funds last year. They wrote, “Less volatile funds likely will outpace the indexes during bear markets and earn healthy overall returns over a full market cycle while giving you more peace of mind.”

Smart investors, however, realize nobody can predict how stocks will perform. They also know that nobody can forecast how specific funds will perform during different market conditions.

Here’s an example from (perhaps) the rockiest sector of all: emerging markets. They often swing like acrobats from a circus trapeze. But their isolated dives and rises aren’t as important as the role they play in a diversified portfolio.

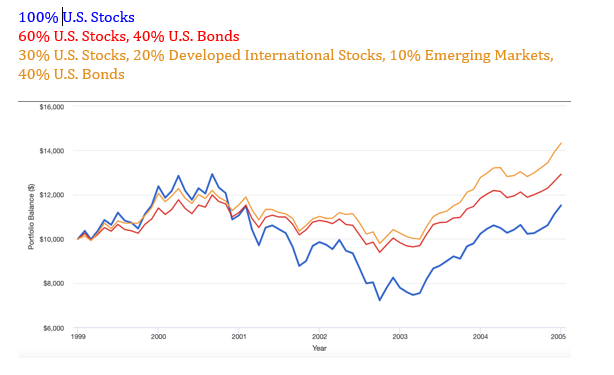

In 1999, U.S. stocks were expensive, as measured by Shiller’s CAPE ratio. Technology stocks led the late-decade rise, much as they’re doing now. Between January 1999 and January 2003, U.S. stocks dropped 22 percent. A balanced portfolio comprising 60 percent U.S. stocks and 40 percent U.S. bonds would have dropped almost 7 percent.

But if the portfolio included 30 percent U.S. stocks, 20 percent developed international stocks, 10 percent emerging market stocks and 40 percent U.S. bonds, the portfolio would have dropped just 2.3 percent. Note the chart below.

Diversification With Riskier Asset Classes

Can Enhance Returns and Cushion Falls

1999-2004

Source: porfoliovisualizer.com

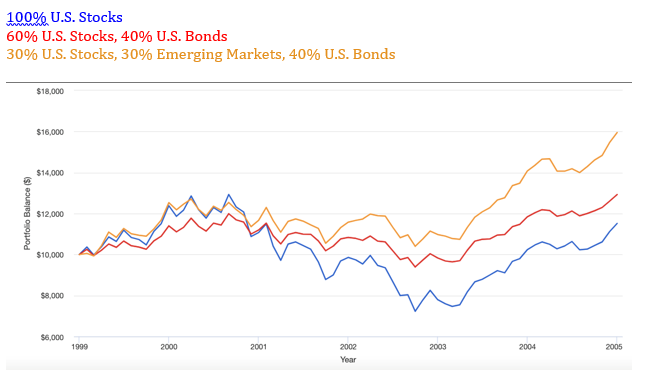

I can hear what you might be thinking. This example only includes 10 percent in emerging market stocks. So, to emphasize a point, let’s see what would have happened if we pushed that exposure up.

As seen in the yellow line below, a portfolio comprising 30 percent U.S. stocks, 30 percent emerging market stocks and 40 percent U.S. bonds would have gained about 4 percent from January 1999 to January 2003. No, I wouldn’t recommend this portfolio. But emerging markets (despite being riskier, in isolation) helped the portfolio stay afloat when developed markets hit the mat.

Diversification With Riskier Asset Classes

Can Enhance Returns and Cushion Falls

1999-2004

Source: porfoliovisualizer.com

It’s important to remember, however, that smart investors don’t shift allocations (or add specific funds) based on how they think stocks will perform. Instead, they maintain a diversified portfolio of low-cost index funds. They include exposure to U.S. and international shares (including emerging markets). They realize nobody can predict the future.

Let’s circle back to that Kiplinger’s story, “The 5 Best Mutual Funds for a Rocky Market.” In February 2019, they recommended the five funds below. Note how they’ve performed this year, to September 17, 2020. I compared them to several of Vanguard’s Target Retirement funds. These are complete portfolios of U.S. stocks, developed international stocks, emerging market stocks and bonds. Their allocations range from 65 percent stocks and 35 percent bonds for the Target Retirement 2030 fund to about 90 percent stocks and 10 percent bonds for the Target Retirement 2045 fund.

Vanguard Equity Income (VEIPX)

AMG Yacktman Focused N (YAFFX)

American Funds Mutual FI (AMFFX)

Dodge & Cox Balanced (DODBX)

Vanguard Wellington (VWELX)

Kiplinger’s Picks Fail In The Rocky Market

January 2020 – September 17, 2020

| Funds | YTD Performance | Value of $10,000 at market’s low (3/23/20) | YTD f Value of $10,000 as of 9/17/20 |

|---|---|---|---|

| Vanguard Equity Income (VEIPX) | -7.79% | $6,564.94 | $9,220.83 |

| AMG Yacktman Focused N (YAFFX) | -0.87% | $7,108.56 | $9,912.71 |

| American Funds Mutual FI (AMFFX) | -2.59% | $7,158.02 | $9,740.91 |

| Dodge & Cox Balanced (DODBX) | -4.35% | $6,970.67 | $9,565.38 |

| Vanguard Wellington (VWELX) | +2.02% | $7,637.89 | $10,202.23 |

| Diversified Portfolios | |||

| Vanguard Target Retirement 2030 Fund | +3.54% | $7,661.49 | $10,354.32 |

| Vanguard Target Retirement 2035 Fund | +2.82% | $7,429.45 | $10,282.32 |

| Vanguard Target Retirement 2040 Fund | +2.41% | $7,204.47 | $10,240.99 |

| Vanguard Target Retirement 2045 Fund | +2.57% | $6,995.98 | $10,257.03 |

No matter how you slice it, the diversified portfolios did their job. Generally, they dropped less than Kiplinger’s “picks for a rocky market.” And they made more money, too.

That’s why investors shouldn’t be swayed by salesmanship. Nobody can pick the best funds for a rocky market. Always ignore market predictions or stories about the best funds to buy now. Instead, build a diversified portfolio of low-cost index funds or ETFs and let diversification do its job.

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller, Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.